By Lisa Ferdinando, DoD News, Defense Media Activity

WASHINGTON -- The Defense Department has identified more

than 130,000 veterans who may be eligible for a refund for taxes paid on their

disability severance payment, a DoD tax expert said.

Army Lt. Col. David Dulaney, the executive director for the

Armed Forces Tax Council, said the department began mailing notices to veterans

July 9.

The deadline to file for the refund is one year from the

date of the Defense Department notice, or three years after the due date for

filing the original return for the year the disability severance payment was

made, or two years after the tax was paid for the year the disability severance

payment was made, according to the IRS.

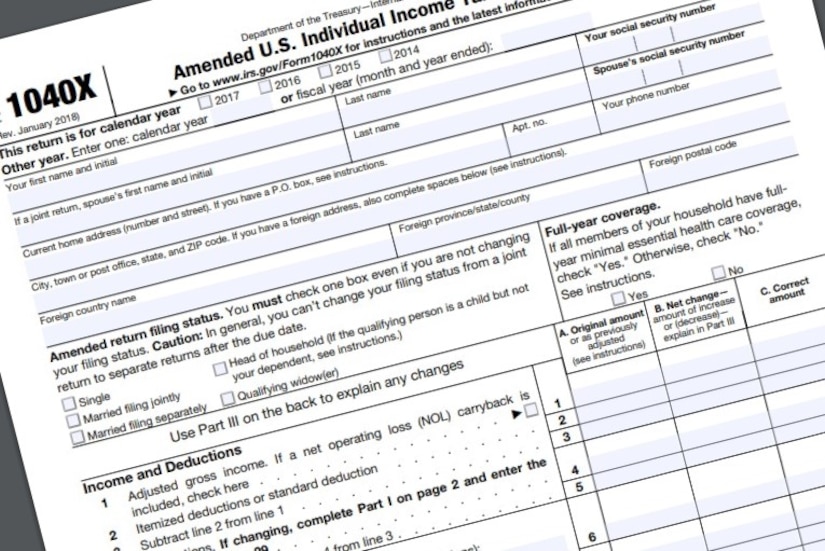

Affected veterans can submit a claim based on their actual

disability severance payment by submitting to the IRS a completed Form 1040X,

the Amended U.S. Individual Income Tax Return, Dulaney said.

The IRS also has approved a simplified method for obtaining

the refund, in which veterans can claim the standard refund amount on Form

1040X based on when they received the disability severance payment. Those

standard refund amounts are $1,750 for tax years 1991 to 2005, $2,400 for tax

years 2006 to 2010;, and $3,200 for tax years 2011 to 2016.

Dulaney pointed out the disability severance payment is not

taxable or subject to federal income tax withholding for a veteran meeting

either of these criteria:

-- The veteran has a combat-related injury or illness as

determined by his or her military service at separation that resulted directly

from armed conflict; took place while the member was engaged in extra-hazardous

service; took place under conditions simulating war, including training

exercises such as maneuvers; or was caused by an instrumentality of war.

-- The veteran is receiving disability compensation from the

Department of Veterans Affairs or has received notification from VA approving

such compensation.

Combat-Injured Veterans Tax Fairness Act of 2016

However, many of the veterans had taxes withheld, Dulaney

said. The Combat-Injured Veterans Tax Fairness Act of 2016 remedies that, he

said. The act directed the secretary of defense to identify disability

severance payments paid after Jan. 17, 1991, that were included as taxable

income.

Even if a veteran did not receive a letter from the Defense

Department, the individual may still be eligible for a refund. Dulany

recommends visiting the IRS website and searching “combat injured veterans” for

further information.

Estates or surviving spouses can file a claim on behalf of a

veteran who is now deceased, the IRS explains on its website.

No comments:

Post a Comment